rebalancing exposures is a lot like making love to a beautiful woman

rebalancing exposures is a lot like making love to a beautiful

woman.

you don't want to do it abruptly.

you want to do it gently, smoothly, little by little.

ideally whilst listening to some smooth jazz.

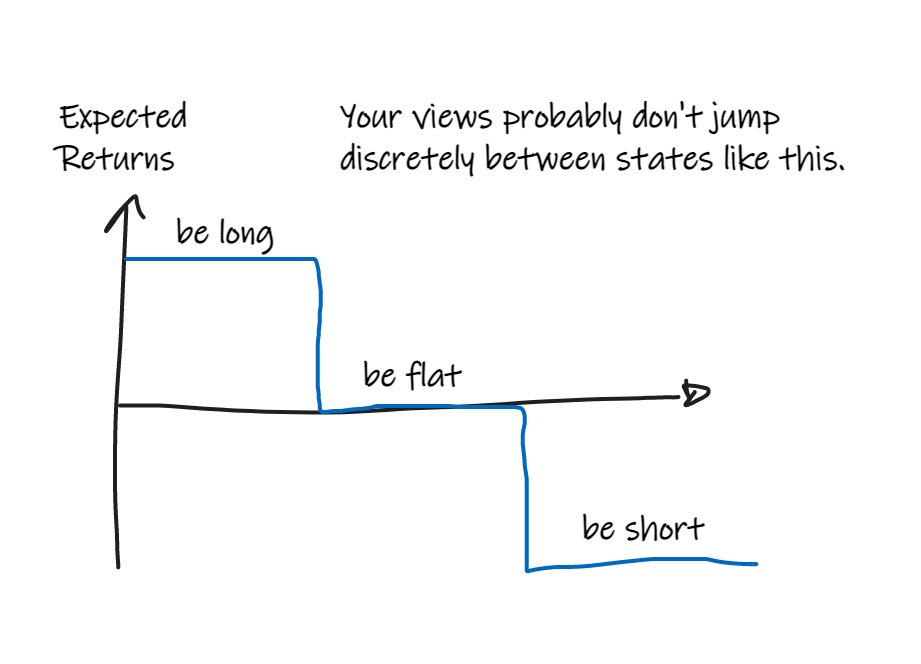

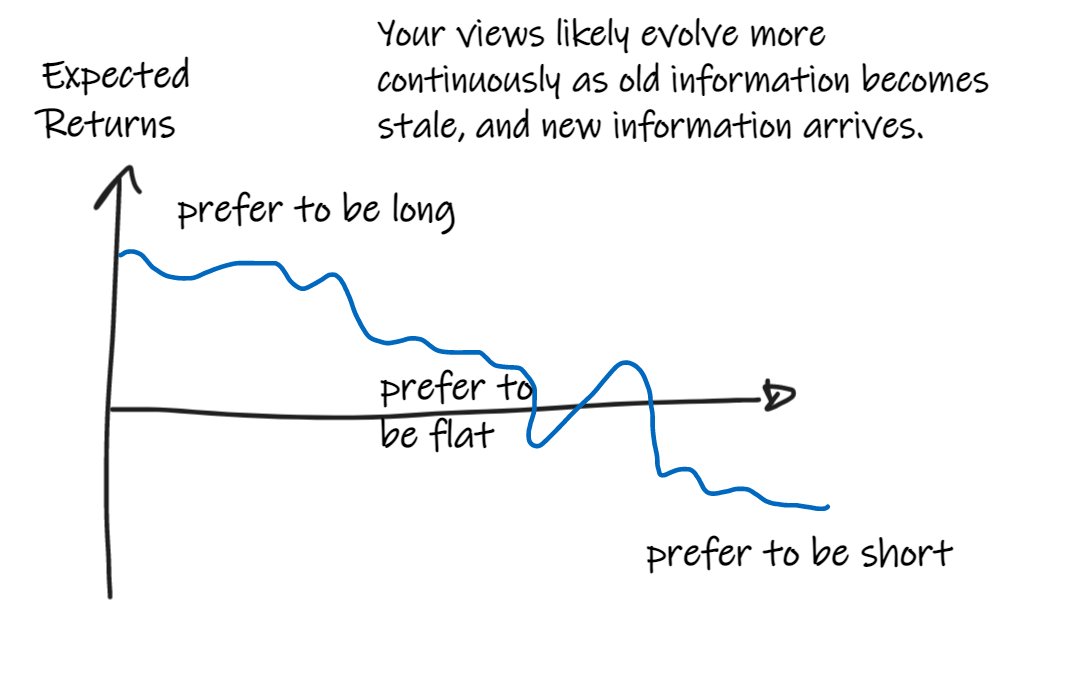

if you're honest about your views on asset returns, it's unlikely they switch between discrete states of wanting to be long, flat, or short.

they're more likely to evolve more continuously than that, as old information becomes stale and new information arrives.

(you might say that your forecasts are "autocorrelated".)

if your views evolve slowly, there's no reason your exposures should change abruptly

between in or out or short.

you can gently flex them to the conditions:

- gently trading into more of what you like right now

- gently trading away from stuff you're in that you like less

in stat arby or positional stuff i don't think about entries or exits - i don't even really care how many positions I have on.

i'm just gently and almost continuously nudging to trade towards things I like and away grom things I like less.

let me give an example from a conversation with a friend earlier today.

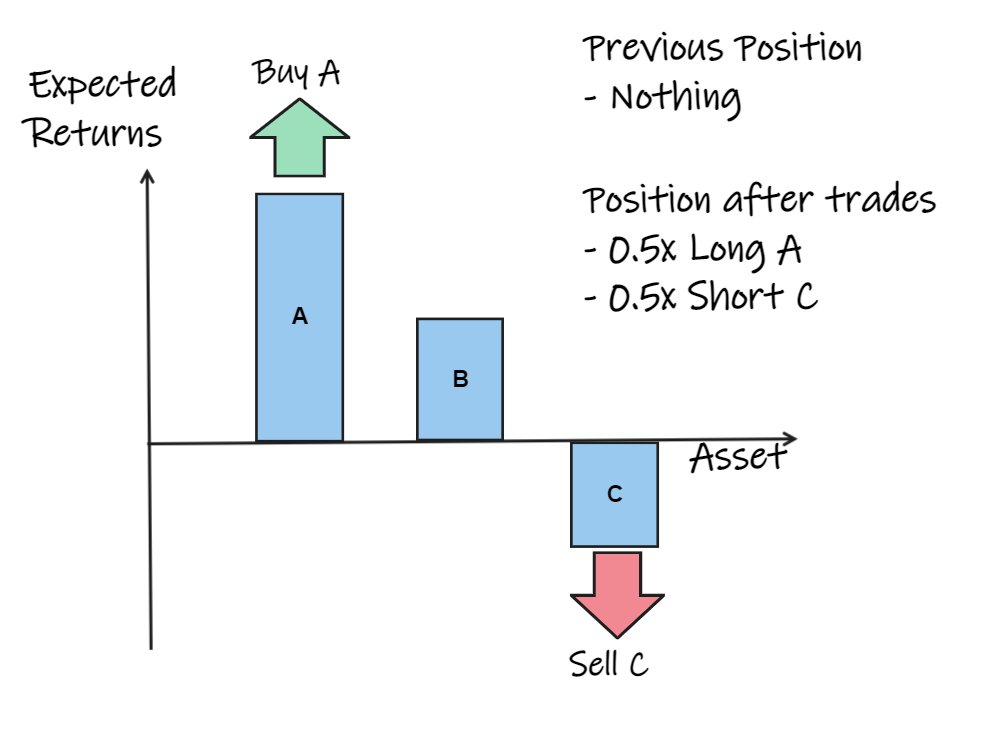

let's say, for simplicity, that he's trading a universe of 3 assets.

every few hours, he ranks them by expected returns.

and trades so that he is equal weighted long the top one, and short the bottom one.

in this case, if his views look like this, he'd be positioned:

- 50% Short A

- 50% Short C

now stuff happens in the market.

old info becomes irrelevant.

new info arrives.

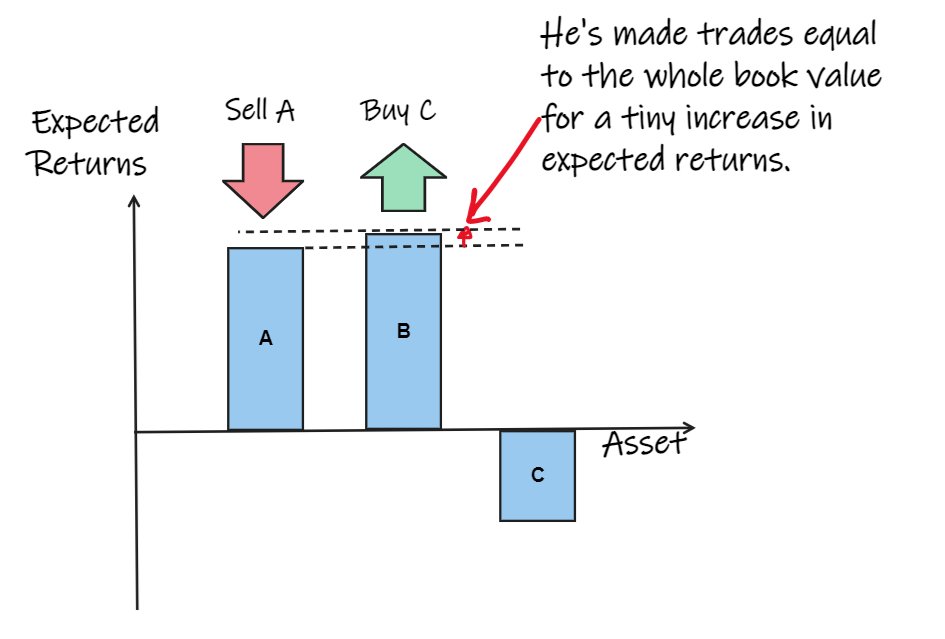

now his views look like this.

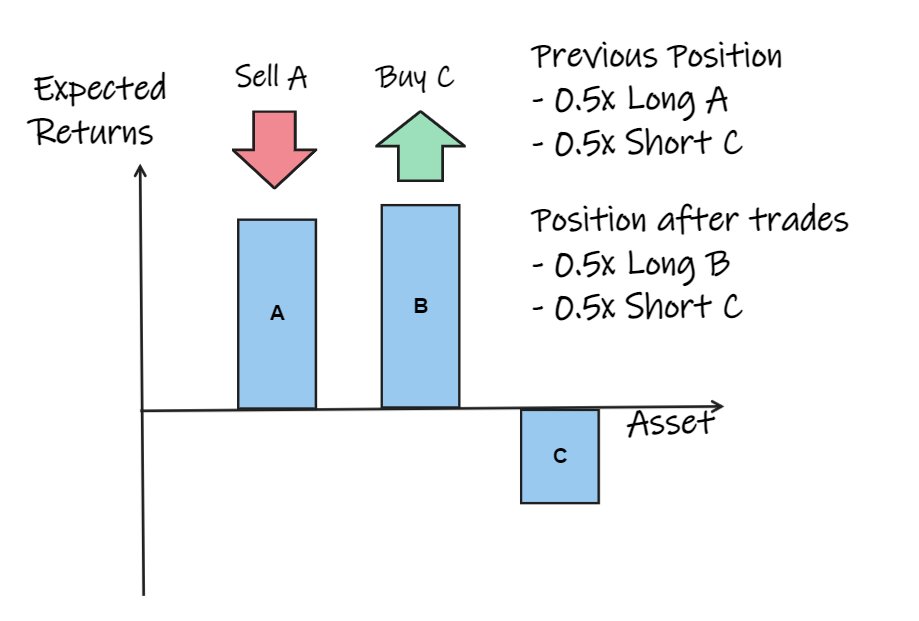

now B has (slightly) higher expected returns than A, so according to his rules, he:

- Sells A

- Buys B to replace it.

but that's an awful lot of trading for a tiny increase in expected returns.

he made trades equal to the whole book size.

that's abrupt. unnecessary.

that's no way to make love to a beautiful woman.

you want to be gentler than this.

you can be gentler if you don't constrain yourself to a fixed number of positions.

that constraint is too limiting. It leads to far more trading (and therefore, cost) than is

necessary.

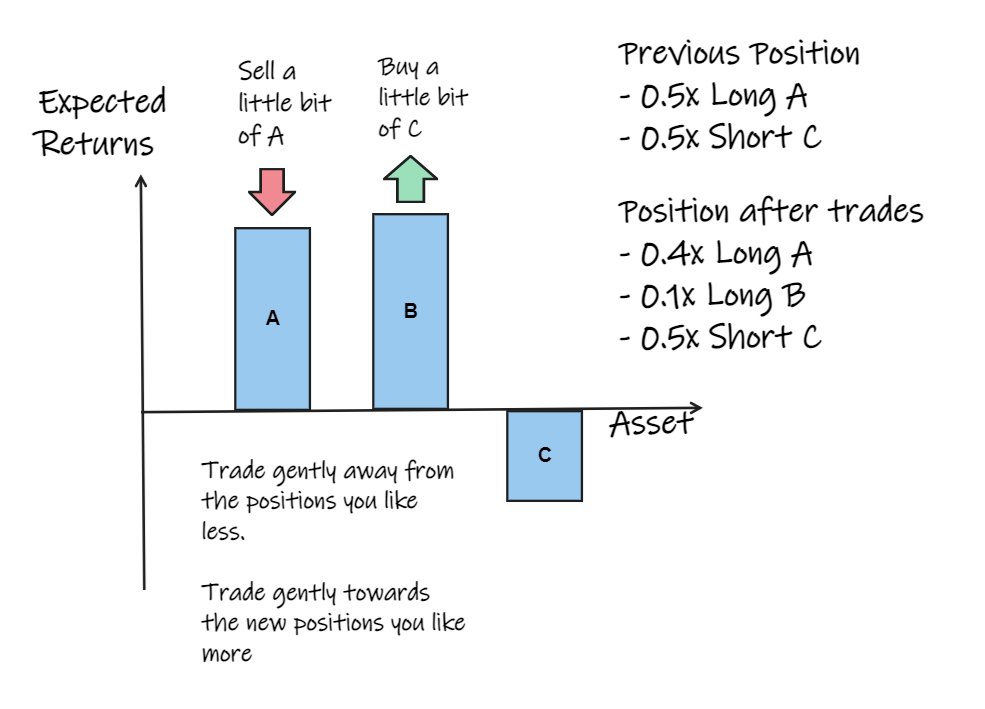

Instead, you'd start:

- gently trading away from A (which you don't like quite as much)

- gently trading towards A (which you now like more)

so, following your first set of trades, you might now be positioned like this:

- 40% Long A

- 10% Long B

- 50% Short C

gently, gently.

focus on trading costs.

you want to be gently trading out of the things you like less, into the things you like more, in a cost-effective way.

"sometimes you gotta make some love a f**kin give her some smooches too"

beep...boop