carrywhoring

one of the regrettable features of many quantifiable things that make money is they often make money most of the time, but tend to smack you in the face occasionally. usually at the worst possible time.

carry trades, long stocks, vol selling, most quant relative value trades.

clearly, you'd rather have a nice positively skewed return profile with the chance of making lots of money occasionally rather than losing lots of money.

but the things we like and make us comfortable tend to be in high demand and, therefore,

tend to be expensive.

so these "comfort" trades tend to be, at least on average, suckers bets.

we should be looking to sell people what they think they want to make themselves

comfortable.

not looking to buy that comfort for ourselves.

at least if we like making money, anyway...

this is one reason carry trades and other forms of risk premia harvesting are expected to

make money.

because it sucks to hold those exposures.

"it's only a matter of time, bro."

it sucking is why you expect to get paid.

if it didn't suck, why would it be too cheap?

so you might identify that there are returns to be harnessed from these kind of trades - but that doesn't mean you're not going to get rekt.

especially if you are a bit green - not yet respectful of the wrath of the market gods.

so... much care and humility is required.

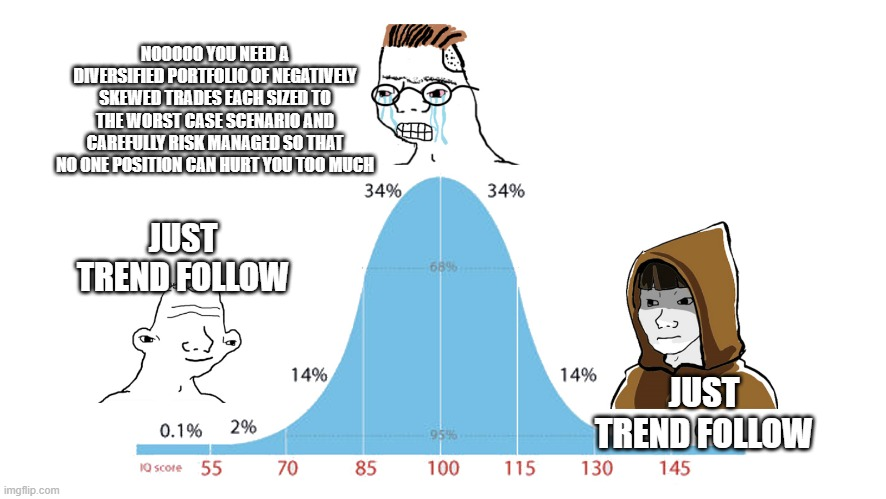

one particular trap many fall in is thinking they are doing something very clever.

you're running some relative value convergence stuff - you're making money consistently high risk adjusted returns.

so far...

don't get carried away.

don't think you've turned into Jim Simons.

"it's only a matter of time, bro."

you're "being paid" to take on tail risk.

that's not a bad thing, per se, as long as you know that's what you're doing. And you size and

diversify accordingly.

but it's lethal if you forget that's what you're being paid for.

beep...boop

..

..

entertaining heckle from @macrocephalopod on twitter on this one: