are you right or are you lucky?

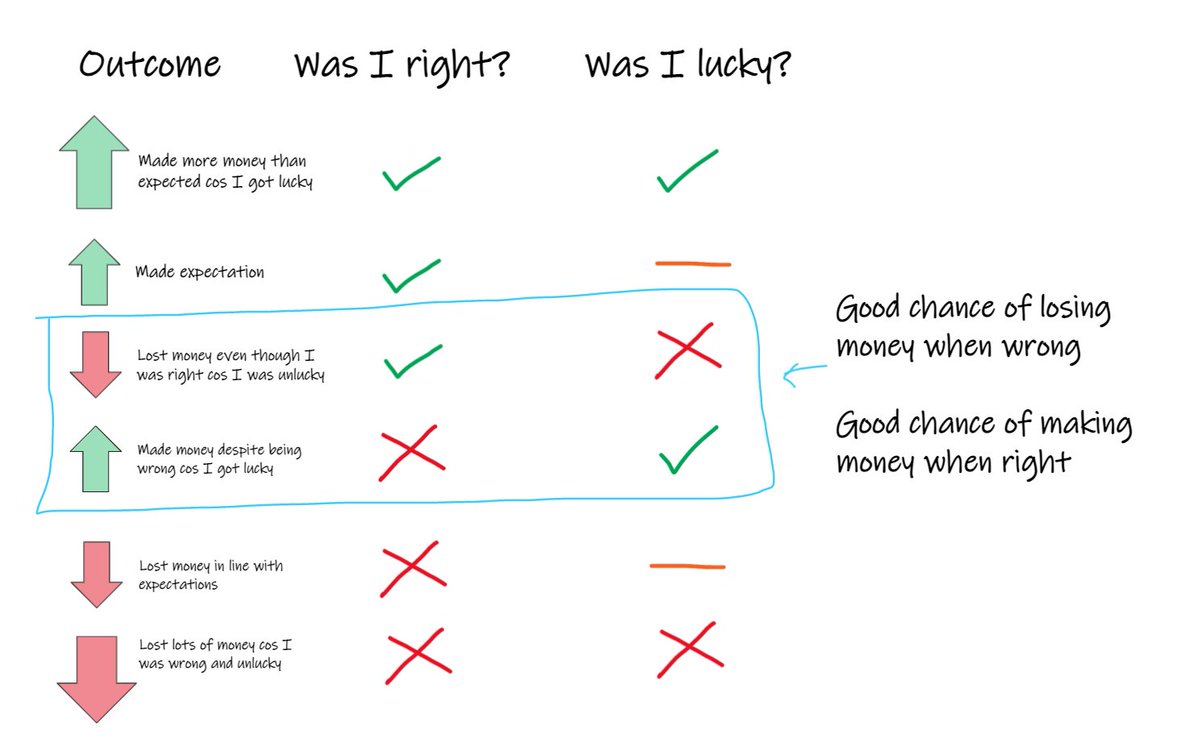

if you put a trade on, the following can happen.

there are two sources of variance in your outcomes:

- am I right or wrong?

- am I lucky? (did random unforecastable events help or hinder my position)

for small numbers of trades, 2 totally dominates.

this is why concentrating big in single ideas is a bad idea, even if you have a ton of conviction.

even if you know you're right, unforecastable random events can easily derail you trade (policy change, whatever)

...and you don't know you're right.

raoul pal recently bought the top in ETH, in a trade that he described as "irresponsibly large".

if that was real, he would have lost a lot of money.

but it would have been a shit trade even if it had made money - because there was so much chance of losing money even if he was "right".

you've got no right betting the farm on coin flip ideas like that.

"how can i not wreck myself if i'm wrong?"

NOT "how can i make the most money, given i know i'm right?"

you never know you're right. and, even when you are, there's still a good chance you'll get unlucky.

beep....boop.